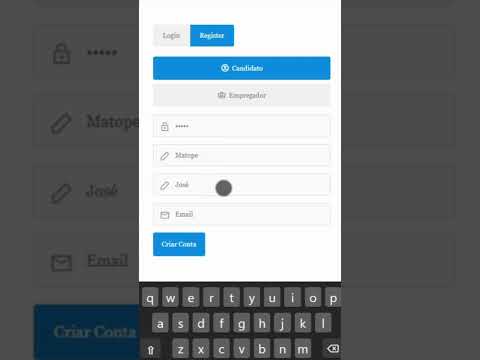

Iniciar sessão

Registar

Vaga para Contabilista da Delegação (Motorcare) Tempo Inteiro

Responsibilities as A Mid-level Manager

List all main responsibilities e.g.:

- Responsible in regard to working areas;

- Communicate strategy, business plan and best practice for the Department;

- Design action and remedial plan to a given business plan;

- Perform follow up to action plan and report to top-manager;

- Suggest changes and improvements to working flow;

- Manage and coach your team in the light of the 10 commandments. (Team 7);

- Develop your team by revising the JD set as a dynamic working tool in a daily basis;

- Be an active part of the Mid-level manager with involvement in all departments;

- Provide feedback to your manager regarding relevant issues already discussed;

- Be aware of the Salaried Employees Act and Collective Agreement by the Confederation of Danish Industries.

Requirements:

List all requirements e.g.:

- Completed Accounting or Financial degree with a minimum of Bachelor;

- Strong Administration skills;

- English communication;

- Sounding leadership skills;

- Computer literacy MS Office 2010+ and accounting software;

- Committed with time and targets.

Specific responsibilities/duties:

Financial Control – Monitoring and Management of Petty Cash

- Verification and assurance that all vouchers are approved by heads of departments and cash or cheque stamp is applied on all payments. Finance Manager (FM) and/ or General Manager (GM) counter signing on the cash reports;

- Cash count every single day (together with the Internal Controller);

- Very and reconcile all cash count differences;

- Follow up on long petty cash vouchers/requisitions not yet justified.

Bank

- Prepare and/ or delegate preparation of bank reconciliations for all accounts on a monthly basis;

- Prepare fortnightly reconciliations for all MZM Bank accounts (Deadline every 18th of the month);

- Follow up on all outstanding items in the bank reconciliation (Maximum outstanding is 2 months).

DEBTORS

• Ensure that all payment receipts are entered into the system control;

• Perform constant follow up on the ‘unknown Payments Account’;

• Ensure timely and prompt book keeping of payments.

OTHER DEBTORS

• Reconcile all other receivable accounts on a monthly basis and follow up on all outstanding items;

• Make sure Bank Exchange Rates and exchange rates received from HQ are updated in the system control for a month ending figures (Deadline 1st working day of the month).

RECONCILIATIONS

Responsible for end month reconciliations:

FIXED ASSETS

• Update the reconciliations with disposals, additions and depreciations;

• Ensure correct calculation of depreciation and that the exchange rate adjustment is entered to the Equity;

• Ensure that assets which are no longer physically available – and where the book value is zero – are removed from the fixed assets schedule by invoicing at 1 USD.

• Ensure that there are no negative book values.

STOCK

• Ensure lists reconciled to ledger accounts (parts and vehicles).

DEBTORS

• Reconcile debtor lists to ledger accounts.

LIQUID FUNDS AND BANKS

• At the end of the week, there should be a cash count by the FM/ DFM or GM and signed by both the cashier and the Manager.

• Approve reconciliations;

• Give instruction for transfer of payments to HO;

• Give instruction for follow up on cheques not cleared.

CREDITORS

• Reconcile creditor list to ledger account.

CURRENT ACCOUNT

• Verify reconciliations;

• Give instructions and/or follow up any outstanding items on the current accounts.

Monthly accruals, prepaid accounts, private outstanding and wages prepaid/ savings.

• Prepare and reconcile all above mentioned.

SALARY

• Update employees accounts for private and / or petty cash advances (deadline: 20th of every month);

• Ensure written approval by FM/BM of the salaries;

• Issue transfer letters to employees’ accounts whenever necessary;

• Ensure salary transfer to employees’ bank accounts. Deadline is 25th of following month.

• Ensure payment of salary tax (IRPS and pension INSS) within approved deadlines;

VAT

• Prepare all VAT returns and ensure that reported/declared turnover reconciles with the YTD reported turnover.

• Ensure payment of VAT and / or submission by every month end.

YEAR END

• Prepare annual accounts for Auditors: Deadline is end of January.

• File Approved Annual Accounts with the company register: Deadline is 31st of May.

APPORVAL OF COSTS AND / OR INVOICES

• Both the head of the department and MD to sign the tax invoice.

PAYMENTS

• Ensure collection of two signatories: BM and/ or FM.

CHEQUES

• Ensure two signatories: MD and FM

• This includes cash form the bank where the cheque is opened.

HR

• Manage people under your responsibility or reporting to you;

• Coach them on a daily basis;

• Develop individual function description;

• Organize individual meetings at least once a quarter;

• Give inputs to FM on staff performance monthly by tracing an existing clear job role description.

Empregos Relacionados

Director Geral Tempo Inteiro

PEP MaputoA PEP Moçambique pretende recrutar para o seu quadro de pessoal um (1) Director Geral. Responsabilidades Traduzir a estratégia da...

Candidatar-se a este empregoVisão Geral do Trabalho

-

ID: 32738

-

Data publicada:

-

Localização: Moçambique

-

Título do Trabalho: Vaga para Contabilista da Delegação (Motorcare)

- 217 Vagas abertas

- 99275 Currículos

- 16360 Empresas

- 12 Anos Online